T

H

Headless Payments

Headless Payments

What are Headless Payments?

Headless Payments refer to a payment architecture where the customer-facing presentation layer (the "head") is completely decoupled from the backend transaction processing logic (the "body"). In this setup, the frontend-whether it's a mobile app, a website, a voice assistant, or an IoT device-communicates with the payment processing engine exclusively through APIs. This stands in contrast to traditional "monolithic" payment systems where the checkout UI is hard-coded into the backend platform, restricting customization and portability.

Deep Dive: The Architecture of API-First Commerce

In the broader context of Headless Commerce, payments are treated as a microservice. This separation of concerns allows for distinct development lifecycles: frontend teams can iterate on the user interface (UI) without risking the integrity of the backend payment logic.

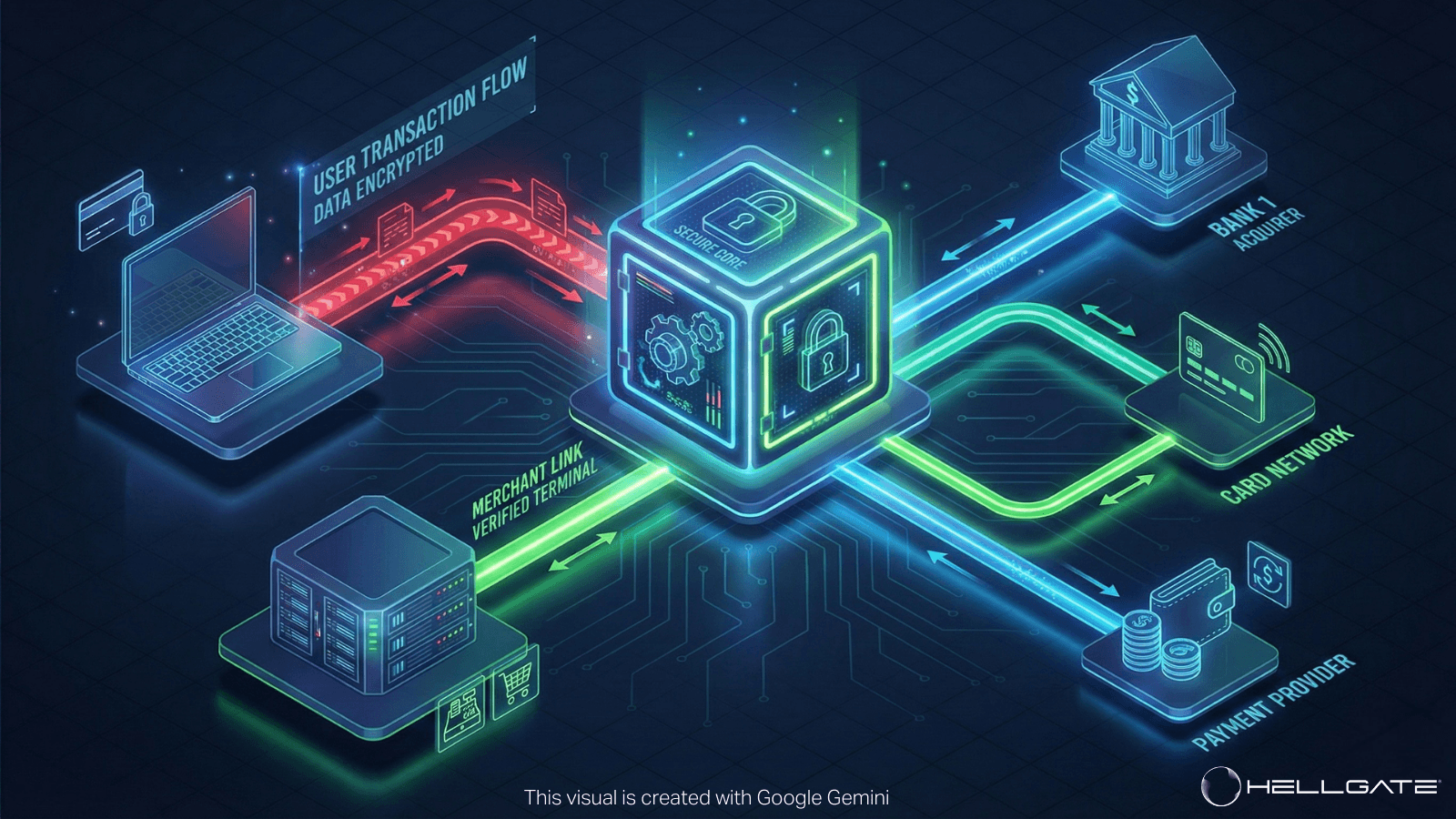

1. Technical Mechanics: The API Bridge

The engine of headless payments is the API (Application Programming Interface).

The Frontend (Head): The merchant builds a custom checkout form using frameworks like React, Vue, or Angular. This layer handles the user input (card details, shipping address).

The Bridge: When the user clicks "Pay," the frontend sends the data payload to the API endpoint of the payment service.

The Backend (Body): The API processes the transaction (validation, risk check, authorization) and returns a simple JSON response (Success/Fail) to the frontend, which then renders the appropriate confirmation screen.

2. Strategic Importance

True Omnichannel: Because the backend has no "opinion" on how the frontend looks, the same payment engine can simultaneously power a web checkout, a mobile app, a smart speaker transaction, and a "Buy Now" button on a social media feed.

UX Autonomy: Merchants are not forced to use a provider's generic, iframe-based hosted payment page. They can design a checkout flow that perfectly matches their brand identity.

Speed to Market: Marketing teams can launch new sales channels (e.g., a pop-up store or a metaverse integration) by simply connecting a new "head" to the existing payment "body," without re-architecting the core processing logic.

3. Comparison: Monolithic vs. Headless

Feature | Monolithic (Traditional) | Headless (Modern) |

Structure | Coupled (Frontend & Backend merged). | Decoupled (API-connected). |

Customization | Limited (Templates/Iframes). | Unlimited (Custom Code). |

Updates | Risky (Frontend change affects Backend). | Safe (Independent deployment). |

Channels | Web-focused. | Device Agnostic (IoT, Mobile, Web). |

PCI Scope | Often handled by Provider (Hosted Page). | Managed via Fields/Tokens. |

Common Pain Points in Headless Implementation

While powerful, "going headless" shifts the burden of building the user experience onto the merchant.

Development Resources: Unlike a plug-and-play plugin, headless setups require skilled frontend developers to build and maintain the checkout UI.

PCI Complexity: Since you aren't using a hosted redirect page, you must ensure your custom frontend handles data securely (typically via Fields or Network Tokens) to avoid massive PCI compliance scope.

Feature Parity: You lose "out-of-the-box" features. If you want Apple Pay or a BNPL option, you must explicitly code the UI elements for them, rather than just toggling a switch in a plugin.

The Hellgate Approach

Hellgate is built as an API-first platform, making it the native engine for Headless Payment strategies.

Link (Connectivity): acts as the unified API gateway. A developer connects their custom frontend to Link once, and can then dynamically swap underlying providers (Stripe, Adyen, Chase) without touching a single line of frontend code.

Commerce (Engine): Provides the necessary backend logic for headless setups-managing the cart state, tax calculations, and final settlement-so developers only need to build the UI, not the accounting logic.

Guardian (Security): Solves the PCI challenge in headless environments. By using Guardian's tokenization fields, developers can build a fully custom checkout form where raw card data is intercepted and tokenized before it ever touches the merchant's server, keeping the "Head" secure.

Frequently Asked Questions (FAQ)

Q: Is Headless Payments the same as an SDK?

A: Not exactly. An SDK (Software Development Kit) is a set of tools used to build headless experiences. Headless is the architectural concept of separating the frontend and backend.

Q: Do I need a Headless CMS to use Headless Payments?

A: No, but they often go together. A Headless CMS handles the product content (images, descriptions), while the Headless Payment engine handles the transaction. Both connect to your custom frontend via APIs.

Q: Is Headless faster for the customer?

A: Generally, yes. Because the frontend is decoupled, it can be built as a lightweight "Single Page Application" (SPA) that loads instantly, without waiting for heavy backend legacy systems to render the page.

Q: Can I use 3D Secure with Headless Payments?

A: Yes. Modern APIs support 3D Secure 2.0. The API response will simply instruct your frontend to display the bank's challenge modal/window when authentication is required.